Debt to Equity Ratio Formula Analysis Example

D/E ratios should always be considered on a relative basis compared to industry peers or to the same company at different points in time. Basically, the more business operations rely on borrowed money, the higher the risk of bankruptcy if the company hits hard times. The reason for this is there are still loans that need to be paid while also not having enough to meet its obligations. It shows the proportion to which a company is able to finance its operations via debt rather than its own resources.

Create a Free Account and Ask Any Financial Question

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. A debt ratio of 0.2 shows that it is very unlikely for Company C to become bankrupt, even if the economy were to crush. This means that for every $1 invested into the company by investors, lenders provide $0.5. Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more.

Earnings To Watch: Sonendo Inc (SONXD) Reports Q3 2024 Result

Therefore, the D/E ratio is typically considered along with a few other variables. One of the main starting points for analyzing a D/E ratio is to compare it to other company’s D/E ratios in the same industry. Overall, D/E ratios will differ depending on the industry because some industries tend to use more debt financing than others.

What Does It Mean for a Debt-to-Equity Ratio to Be Negative?

A D/E ratio of 1.5 would indicate that the company has 1.5 times more debt than equity, signaling a moderate level of financial leverage. For instance, utility companies often exhibit high D/E ratios due to their capital-intensive nature and steady income streams. These companies frequently borrow extensively, given their stable returns, making high leverage ratios a common and efficient use of capital in this slow-growth sector. Similarly, companies in the consumer staples industry tend to show higher D/E ratios for comparable reasons. If a company cannot pay the interest and principal on its debts, whether as loans to a bank or in the form of bonds, it can lead to a credit event. The D/E ratio is one way to look for red flags that a company is in trouble in this respect.

For shareholders, it means a decreased probability of bankruptcy in the event of an economic downturn. A company with a higher ratio than its industry average, therefore, may have difficulty securing additional funding from either source. A decrease in the D/E ratio indicates that a company is becoming less leveraged and is using less debt to finance its operations. This usually signifies that a company is in good financial health and is generating enough cash flow to cover its debts.

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail. Investors may check it quarterly in line with financial reporting, while business credit policy owners might track it more regularly. Currency fluctuations can affect the ratio for companies operating in multiple countries. It’s advisable to consider currency-adjusted figures for a more accurate assessment.

This means that for every dollar of equity, the company has 20 cents of debt, or leverage. Understanding the average Debt to Equity ratio in your industry helps contextualize your company’s financial standing. This comparison can inform strategic decisions regarding financing and growth. The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another.

- That makes debt an attractive way to fund business, especially compared to the potential returns from the stock market, which can be volatile.

- The D/E ratio is one way to look for red flags that a company is in trouble in this respect.

- While this can lead to higher returns, it also increases the company’s financial risk.

- A high debt to equity ratio means that a company is highly dependent on debt to finance its growth.

- They may note that the company has a high D/E ratio and conclude that the risk is too high.

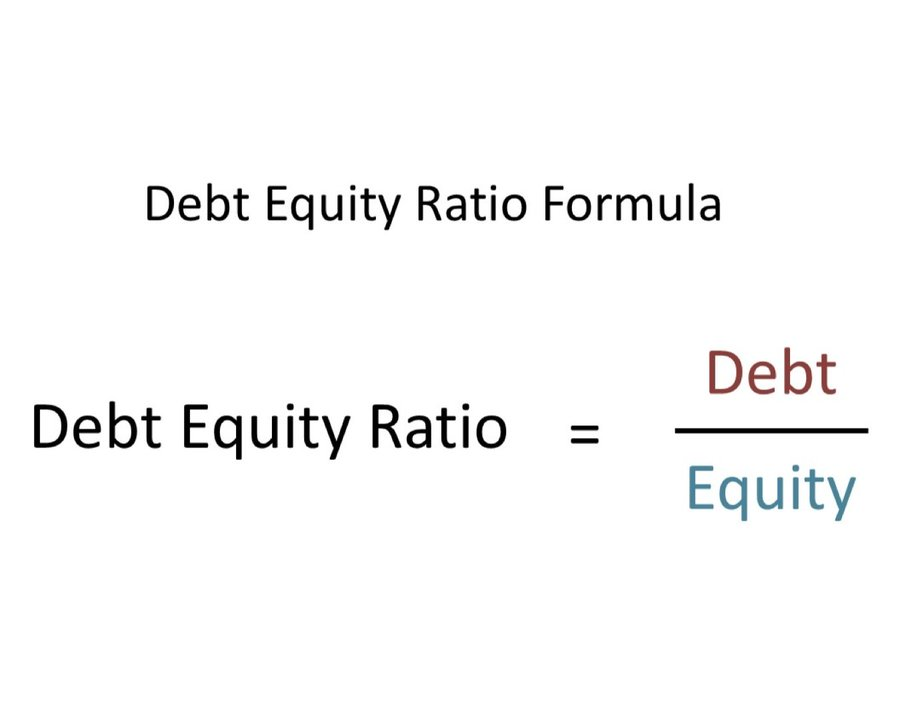

It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity. The D/E ratio of a company can be calculated by dividing its total liabilities by its total shareholder equity. If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. On the other hand, companies with low debt-to-equity ratios aren’t always a safe bet, either.

These assets include cash and cash equivalents, marketable securities, and net accounts receivable. Different industries vary in D/E ratios because some industries may have intensive capital compared to others. Managers can use the D/E ratio to monitor a company’s capital structure and make sure it is in line with the optimal mix. Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity. The ever popular one-page Snapshot reports are generated for virtually every single Zacks Ranked stock.

Debt to equity ratio also measures the ability of a company to cover all its financial obligations to creditors using shareholder equity in case of a decline in business. Additional debt issuance, debt repayment, equity issuance, stock buybacks, or changes in retained earnings can all impact the debt and equity components, leading to changes in the ratio. Yes, a company can have a negative debt/equity ratio if its total debt is less than zero, and its shareholders’ equity is positive. This situation is rare and usually occurs when a company has negative retained earnings, leading to negative equity.

For instance, a company with $200,000 in cash and marketable securities, and $50,000 in liabilities, has a cash ratio of 4.00. This means that the company can use this cash to pay off its debts or use it for other purposes. The cash ratio provides an estimate of the ability of a company to pay off its short-term debt. Using the D/E ratio to assess a company’s financial leverage may not be accurate if the company has an aggressive growth strategy. For example, asset-heavy industries such as utilities and transportation tend to have higher D/E ratios because their business models require more debt to finance their large capital expenditures. Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000.